Risk Measurement

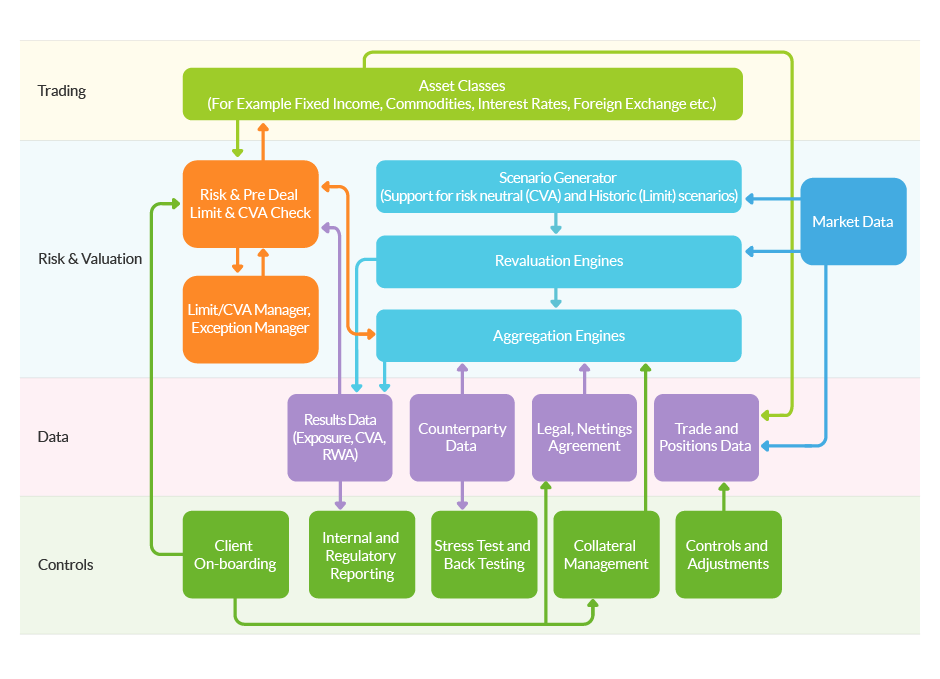

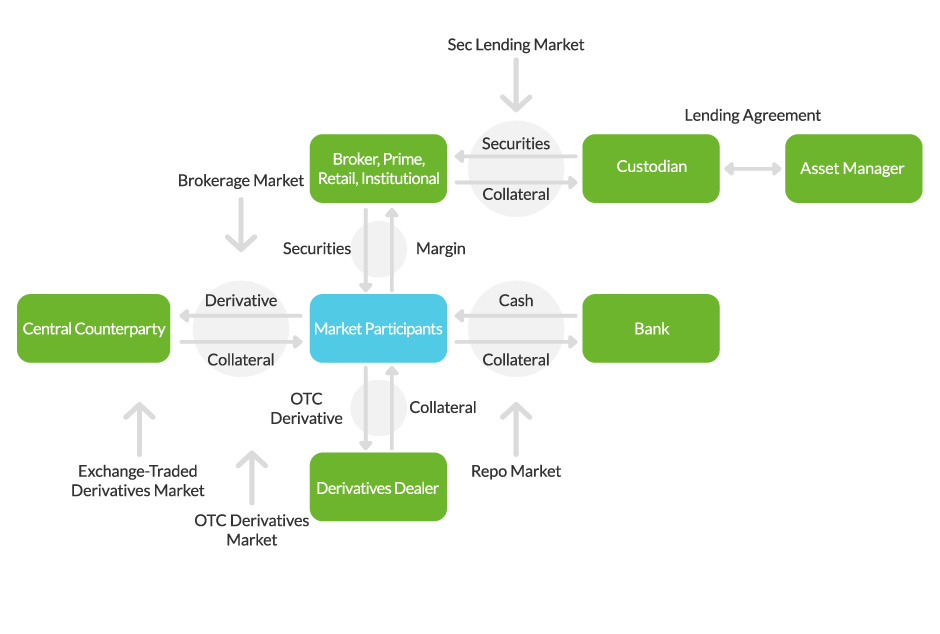

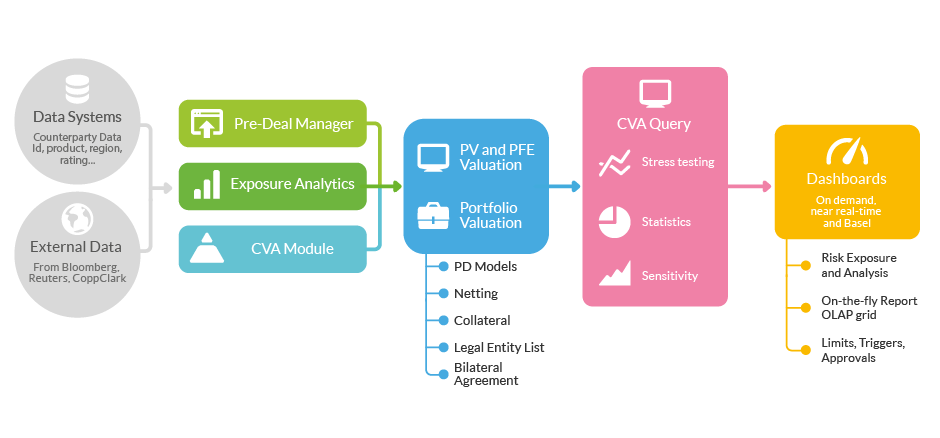

Take advantage of the best global analytics practices, including exposure calculation (EE, PFE, CVA), Monte Carlo simulations, and stress testing, while answering the growing regulatory demands. PrevioRisk seamlessly integrates to your current data and BI systems, thus allowing you to leverage high-power simulation engine by market leading analytics such as MSCI RiskMetricsTM.

Visualization

Sift through the sea of interactive data, using the game-changing risk dashboards that provide full view of the portfolio and allow to spot at first sight the numbers relevant for decision-makers: CEO, CRO, traders, fund managers compliance officers, and board members. PrevioRisk's customizable modules and user-friendly interface ensure that real-time data remain accessible, logical, relevant and actionable.

Communication

PrevioRisk's smart dashboards, convenient limit approval mechanism and extensive reporting capabilities immediately improve connectivity within the institution, as well as with its clients and regulators. The power of enhanced communication creates a huge competitive advantage for your company, while providing full transparency of risk-management processes and measures for compliance checks.

Do you want to get the best of the both worlds? With PrevioRisk you benefit from market leading analytics with certainty that they are used by top-tier financial institutions, as well as you get strong advantages of dealing with a small and result-oriented firm, including extensive product training, tailored implementation, and customer care.

Modules

Benefits

Mission Clarity

Regulatory Compliance

Many Components – One Solution

Onboarding Simplicity

Enterprise-Wide, On Demand Risk Information Dashboards

No Surprises Approach

Real-Time Update

Leverage Our Human Capital

Excellent Customer Service

We Are Small Enough To Care!

We predict risks.

We predict risks.