Delta sensitivities are usually computed to show Present Value response to 100% change in underlying market factors.

However, we can define risk factor, which has the highest expected impact on Present Value.

Delta sensitivities are usually computed to show Present Value response to 100% change in underlying market factors.

However, we can define risk factor, which has the highest expected impact on Present Value.

The delta equivalents of a position describe the response of a position/portfolio to a change in the market data.

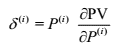

Delta equivalent is the derivative of the Present Value with respect to a given risk factor, multiplied by the value (price) of that particular risk factor:

Read more…