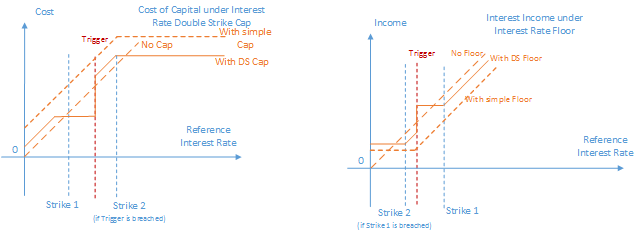

Double Strike Floor and Double Strike Cap (N-Floor and N-Cap) are modifications of the Interest Rate Floor/Cap. In a Knock-Out Floor/Cap, once the trigger rate is breached (Knock-Out or KO event), the protection of the Floor disappears for that period. In a Knock-In Floor/Cap, protection does not appear unless the trigger is breached (Knock-In or KI event). Here are examples of payoff profiles for Double Strike Floor and Cap.

Multiple strike derivatives give additional option once first strike (trigger) is traded. With an N-Floor, once the trigger is reached the original floor level is replaced with new floor level for that period. That makes the contract more risk averse than simple Floor with barrier. As payoff for double strike products is smaller at some positions of interest rate that makes them significantly cheaper.

As can be seen from the figure below, DS Cap can protect investor from significant increase of interest rates muck better that simple Cap. Dual Strike Floor, similarly, has higher limit for potential losses from significant interest rate decrease. The price of this protection is first barrier which “clears” memory of instrument in case of high market volatility.

For example, let’s consider investor who has a 3-years floating rate asset with payoff based on LIBOR. While investor believe that LIBOR will stay high and potentially increase further, he wants some interest rate protection. Investor can purchase 0.6% Floor for 225 basis points. Alternatively, he can enter Double Strike Floor as follows: 3-year 0.6% floor, trigger at 0.5%, and second floor level at 0.4%. In this case investor would have 0.6% floor unless interest rate is between 0.5% and 0.6%, and if rate is below 0.5% then floor is replaced with new 0.4% cap for that period. The cost of second option would be approximately twice lower.